Get the free adp paystub generator

Show details

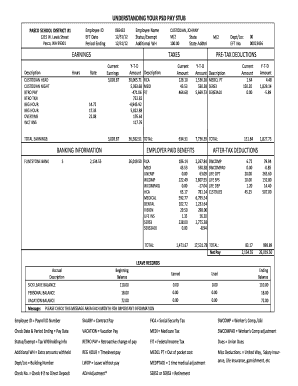

ON-LINE PAY STUBS Your pay stub and annual W-2 is accessible through an on-line application called pay. Our payroll service bureau, ADP, maintains this website. You first have to register, and then

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign adp pay stub template with calculator form

Edit your adp pay stub template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adp pay stub generator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit adp check stub maker online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit adp paystub template form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out adp pay stub template with calculator pdf form

How to fill out adp pay stub template:

01

Collect all necessary information such as employee name, address, and social security number.

02

Enter the employer's information, including the company name and address.

03

Input the pay period start and end dates.

04

Fill in the employee's wage information, including the hourly rate, hours worked, and any overtime or bonuses.

05

Calculate and enter the gross pay, which is the total amount before deductions.

06

Deduct any taxes, such as federal, state, and local income taxes, as well as social security and Medicare taxes.

07

Subtract any pre-tax deductions, such as health insurance premiums or retirement contributions.

08

Subtract any post-tax deductions, such as employee contributions to a 401(k) plan or garnishments.

09

Calculate the net pay by subtracting all deductions from the gross pay.

10

Provide a breakdown of the deductions, including the amount and purpose for each deduction.

11

Include any additional information required by your state or company, such as vacation or sick leave balances.

12

Review the completed pay stub for accuracy and make any necessary adjustments.

Who needs adp pay stub template?

01

Employers who want to provide their employees with detailed information about their wages and deductions.

02

Employees who want a record of their earnings and deductions for financial and tax purposes.

03

Payroll departments or administrators responsible for accurately calculating and documenting employee wages and deductions.

Fill

adp pay stub template pdf

: Try Risk Free

People Also Ask about create adp paystub

Can you edit an ADP pay stub?

You can edit an ADP pay stub by navigating to your account's "Pay" section. Then, look for the edit or modify option to make the necessary changes.

Is there a paystub template in Excel?

Simple Pay Stub Template - Excel This payment stub template offers a professional, easy-to-read layout. Enter payments and deductions, and the template will automatically calculate the totals. There is also room to add fine print about payment policies or notices for employees.

Can I make my own pay stub?

You can create pay stubs manually or use payroll software so employees can track wages, taxes and deductions. A pay stub is a financial record that shows the breakdown of an employee's paycheck. A pay stub includes gross wages, commissions and bonuses, taxes, and health insurance premiums.

Does Microsoft Word have a pay stub template?

To help you craft the perfect direct or ePay stub, download one of our premium Pay Stub Templates. You can easily edit our templates in all versions of Microsoft Word. Our files are ready-made and 100% customizable to suit your preferences. This professionally-written template isn't just limited to a computer.

Are you allowed to make your own pay stub?

It is perfectly legal to create your own pay stubs, and you can do so easily using Check Stub Maker. However, creating pay stubs in order to apply for loans and other things is illegal.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute adp paystub creator online?

Easy online adp check stub template completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the pdffiller in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your paystub generator adp and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit make adp paystub on an Android device?

You can make any changes to PDF files, like what is the adp paystub reflect their specific income details, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is adp paystub generator?

The ADP paystub generator is a tool used to create paystubs for employees or contractors, allowing employers to provide a detailed breakdown of earnings, deductions, and net pay.

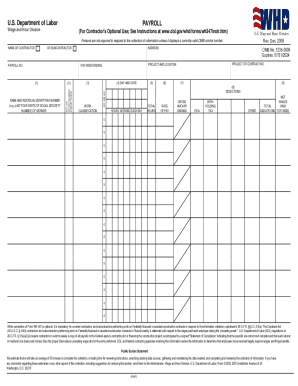

Who is required to file adp paystub generator?

Employers who want to provide employees with paystubs or require documentation for payroll purposes are required to use a paystub generator like ADP.

How to fill out adp paystub generator?

To fill out the ADP paystub generator, you need to input relevant employee information, earnings, deductions, and any other pertinent details regarding the pay period.

What is the purpose of adp paystub generator?

The purpose of the ADP paystub generator is to facilitate accurate payroll processing by providing a formatted document that summarizes an employee's pay and deductions, ensuring transparency and compliance.

What information must be reported on adp paystub generator?

The information that must be reported on the ADP paystub generator includes employee name, pay period dates, gross pay, deductions (such as taxes or insurance), and net pay.

Fill out your adp paystub generator form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Make Adp Check Stubs is not the form you're looking for?Search for another form here.

Keywords relevant to adp check stub pdf

Related to create adp pay stub

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.